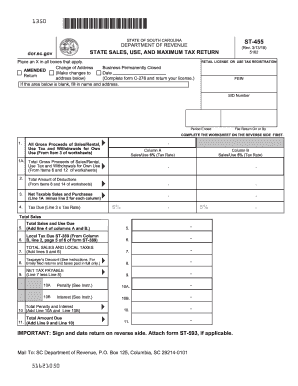

SC ST-455 2019-2024 free printable template

Get, Create, Make and Sign

Editing st 455 online

SC ST-455 Form Versions

How to fill out st 455 2019-2024 form

How to fill out st 455:

Who needs st 455:

Video instructions and help with filling out and completing st 455

Instructions and Help about south carolina st455 form

Music what's up guys my name is Salem Mike I'm here with my friend Allen throughout his gym in Sacramento California untamed strength were here to talk about the bench press were gonna talk about three different mistakes common mistakes that we can help you fix and help you increase your bench press Tom a powerlifter coach content creator I had successfully squatted 590 pounds of bench press 405 and deadlifted 705 pounds and today hopefully I can help you guys increase your strength and your hypertrophy build a more muscle one of the most common mistakes in the bench press is your elbows flaring too early or too late now when we bench press we want to keep our sternum high shoulders tucked behind us that as tight as your back can be we want to squeeze those shoulder blades together this is not only going to stabilize your shoulder, but it's going to allow for proper pressing with using the proper muscles our chest shoulders and triceps while keeping the bar in a perfect path to lift the most amount of weight if your shoulders come untucked, and you come kind of out of their socket you're pressing more with your shoulder one it's going to cause damage to your shoulder and may cause injury in the long run and to your elbows are going to flare outside the barbell we want to keep our elbows underneath if not just in front of the bar to provide optimal Precinct to feel the sensation of what a tight upper back should feel like we like to do band pull the parts you could also do this with a cable machine where you'll hold the band out right in front of you with a grip that's the same width as if you were bench pressing while maintaining your elbows locked out straight arms you'll pull that band until it touches your chest and that should give you the sensation of pouring your shoulder blades together and keeping it tight upper back to support you while you bench press this will warm up our rotator cuffs warm up our rear Delta our mid-back and those are the things that we have to keep as tight as we can to not only stay safe but lift the most amount of weight and if you can lift more weight in your training overall you'll have more hypertrophy and build more muscle over a long period of time a common topic of discussion in the bench press is leg drive and how your legs play a role in how much you can bench press and how to set up now I think some of this is a little overrated what we want to do with our legs is as we already built that foundation to press off of with our tight upper back now we want to push our body onto our upper back and keep that back tight our legs are going to allow staying stable without wiggling around and again pushes back on to our traps some keys there are to keep our knees a little lower than our hips that may mean for some of you that your feet may have to be out in more of a wide position you may have to tuck them in a little for some depending on if you're competing or not even going on to your toes and tucking them back...

Fill st 455 form : Try Risk Free

People Also Ask about st 455

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your st 455 2019-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.